Trump backs the oil and coal industries. Is it just paying out the donors or is it a firm policy? Trump has already given up important U.S. positions in the clean-energy sector worldwide. China has already jumped on the opportunities. Is America losing its edge in the clean-tech competition?

THE FACTS

Let the figures talk.

According to Bloomberg New Energy Finance China spent $287.5 billion on clean energy in 2016, while the U.S. spent $58.6 billion.

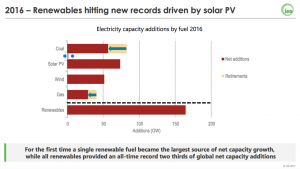

Solar and wind are thriving. According to data from IEA the world is now building more solar than coal generation, a trend that looks to continue, regardless of any uncertainty in current American energy policy. Most new demand for electricity is being supplied by renewable resources, with solar providing the most.

You may think that Trump has already made a positive difference in the coal industry of the U.S. Well, he hasn’t. In the past decade 49 gigawatts of coal-fired power plants have been disconnected in the U.S. and 22 gigawatts in the last two years alone. This trend is unlikely to reverse.

THE FORECAST

Renewables will grow by roughly 1,000 gigawatts over the next five years, the IEA anticipates that.

That is half of the total capacity of coal-fired power plants worldwide, and it has taken 80 years to build all of those capacities.

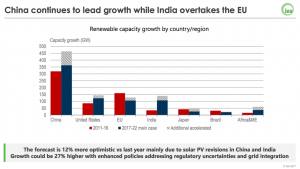

Which countries will take the leading role in the future?

China and India.

NEA (National Energy Administration, China) has recently announced a plan to spend more than $360 billion on renewable power sources like solar and wind through 2020.

Plus, coal-fired power capacity across the country will be capped at 1,100 gigawatts by 2020, the NEA said.

TRUMP’S EFFECT

Will one presidency change the global markets? No, especially with the momentum of China and India gained in the global clean-energy technology market. The market will evolve as predicted. Probably faster than that.

What about the U.S.?

It is obvious: coal is never coming back. Energy utility executives in America know, that the days of coal-based power are over and it is time to invest in wind and solar.

Actually the transition is already happening today. Wind is the cheapest source of energy now in Texas, Oklahoma and Iowa. Texas has the leading edge among the three: more than $32 billion have been invested on windprojects over the past decade. Wind farms provide 12.7% of the state’s total energy production.

The economics of wind overcompensates the love of oil and gas, ranchers and landowners are getting rich watching new turbines spring up across their state. Iowa to the north is making progress too. Warren Buffett, through his MidAmerican Energy Company, a subsidiary of Berkshire Hathaway Energy, is busy building a $3.6 billion project known as Wind XI, installing 1,000 turbines to produce 2 gigawatts of electricity.

Buffet has invested more than $16 billion in renewables in the U.S. and already owns 7% of America’s wind generation capacity, with 6% of its solar generation as well.

Despite Trump’s efforts the companies in the U.S. are not shied away from investing in clean-energy solutions. A fresh APEX/Greenbiz study interviewed 150 business leaders of companies with an annual revenue above 250 mUSD.

More than four in every five respondents plan to be active in the renewable energy market in the next decade and nearly half of them are ramping up their initiatives in the next 2 years.

It seems from the interviews that there is a shift related to the energy procurement. From a commodity contract it is evolving into a cornerstone of a brand-shaping sustainability initiative.

One of the interesting results of the research is that when it comes to achieving sustainability goals, companies are determining their own definition of value.

The top drivers for purchasing renewable energy are:

1, address internal goals

2, show corporate leadership

3, mitigate climate change

All these factors are out of Trump’s range.

The clean-energy evolution seems to be unstoppable.

What do you think?

Leave a Reply